Federal Reserve launches QE3

Saturday 15 September 2012

The Federal Reserve launched another aggressive stimulus program on Thursday, saying it would pump $40 billion into the U.S. economy until it saw a sustained upturn in the weak jobs market.

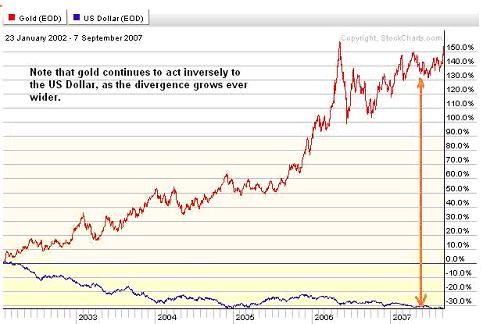

The central bank's decision to tie its controversial bond buying directly to economic conditions was an unprecedented step that marked a big escalation in its efforts to drive U.S. unemployment lower. Stock prices jumped, while gold hit a six-month high as investors braced for higher inflation.

Unlike in its two previous bond-buying sprees, the Fed said it would only purchase mortgage-backed debt, hoping in part to unstick a housing sector that Fed Chairman Ben Bernanke called "a missing piston" in the U.S. recovery.

One top Republican charged that the move was a bid to help President Barack Obama ahead of November's closely contested presidential election. Republican nominee Mitt Romney's campaign said it confirmed the failure of Obama's policies.

Bernanke dismissed talk the Fed was taking sides, saying it acted solely because of the dire state of the U.S. labor market.

"The employment situation ... remains a grave concern," Bernanke told reporters. "While the economy appears to be on a path of moderate recovery, it isn't growing fast enough to make significant progress reducing the unemployment rate."

The economy created just 96,000 jobs last month, less than needed to keep up with population growth. While the unemployment rate edged down to 8.1 percent, it was only because many Americans gave up on the search for work.

By buying mortgage-linked debt, the Fed hopes to press mortgage rates lower, helping the housing market and also encouraging investors in MBS to switch into other assets, lowering their yields as well.

Those lower borrowing costs should spur more lending and foster faster economic growth, officials believe. U.S. growth cooled in the second quarter to a tepid 1.7 percent annual rate, and forecasters do not see the economy doing much better now.

In an additional move, the Fed said it was not likely to raise overnight interest rates from their current near-zero level until at least mid-2015. Previously, it had set such guidance at late 2014.

To underscore its resolve, it said it would pursue an easy monetary policy "for a considerable time" even after the economy strengthened.

"If the outlook for the labor market does not improve substantially, the committee will continue its purchase of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability," the Fed said in a statement.

Asked repeatedly during a post-decision news conference to amplify on that pledge, Bernanke said the Fed wanted to see a convincing improvement in the economy that could deliver sustainable job creation and a gradual decline in unemployment.

"There's not a specific number we have in mind, but what we have seen in the last six months isn't it," he said.

U.S. stocks shot higher on the Fed's move, with the S&P 500 <.SPX> closing at its highest level since December 2007 and the Dow Jones industrial average <.DJI> adding more than 200 points.

Stephen Stanley, an economist at Pierpont Securities in Stamford, Connecticut, said that by tying its purchases to progress reducing U.S. unemployment, the Fed had "basically locked on the handcuffs and swallowed the key."

PUSHING ON A STRING?

Economists said the Fed could eventually buy more than $1 trillion in debt given the open-ended nature of its new policy. Capital Economics estimated purchases could top $1.4 trillion.

The plan fueled some nervousness in financial markets over the potential for inflation, even though the Fed would pull back on its buying if the economy strengthened.

Bernanke stated explicitly that pushing up prices was not the Fed's intention.

The price of gold, a traditional inflation safe haven, hit a six month high, while oil also gained on expectations investors would pile into riskier assets such as commodities and equities.

Prices for most U.S. Treasury debt rose, although the 30-year bond fell, reflecting both disappointment that government debt was not on the Fed's purchase list and inflation worries.

The decision comes in the face of widespread questions about the likely effectiveness of a further foray into unorthodox monetary policy, including from Romney. The Fed has already bought $2.3 trillion in U.S. government and housing-related debt it two rounds of so-called quantitative easing.

Those programs, dubbed QE1 and QE2, bought bonds closer to a pace around $100 billion per month.

Senator John Cornyn, head of the Senate Republican Campaign Committee, said the Fed appeared to be "trying to juice the economy" ahead of the November 6 election, while Lanhee Chen, policy director for the Romney campaign, argued that the Fed's decision pointed to a need for new policies from the White House.

"We should be creating wealth, not printing dollars," Chen said.

The White House, which scrupulously avoids commenting on Fed decisions, declined to be drawn into the debate, but other Democrats rallied to defense of Bernanke, who once served as an adviser to Republican President George W. Bush. It was Bush who first nominated Bernanke to the Fed.

"It is unfortunate that Republicans already have expressed disappointment in this action and are clearly upset that they were unable to intimidate the Fed into putting partisan politics ahead of national economic interests," said Democratic Representative Barney Frank.

The Fed also caused ripples aboard. Brazilian Finance Minister Guido Mantega said he would monitor the impact of the action on Brazil's real currency. Mantega had accused the Fed's earlier bond buying of unfairly weakening the U.S. dollar.

BRIGHTER OUTLOOK

In its statement, the Fed said the fresh MBS purchases, which it will start on Friday, would come on top of its so-called Operation Twist program, in which it is selling short-term bonds to buy longer-term Treasury debt.

With its new MBS purchases, the Fed said it would now be buying about $85 billion in long-term securities each month.

In a reflection of optimism over their new policy path, officials lowered their forecast for the unemployment rate at the end of 2014 to a 6.7 percent to 7.3 percent range, down from a range of 7.0 percent to 7.7 percent in June.

Still, even in 2015, they believe the jobless rate will be above the 5.2 percent to 6 percent range where they think it should eventually settle.

One official, Richmond Federal Reserve Bank President Jeffrey Lacker, dissented against the decision, as he has at every FOMC meeting this year.

(Editing by Andrea Ricci, Tim Ahmann and Andre Grenon)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)