10 Reasons to Always Own Some Gold

Saturday, 2 June 2012

One of the best choices an investor could make is to own some pure gold, since it is the purest form of money. No government, politician, debts, or central bankers can devalue real money over time. Here are ten reasons why you should always own gold as an investor. I’ll be going into more detail in a more comprehensive article soon.

1. Steady Value

Gold is one of the few things that have a history of maintaining its value, unlike coins and paper currency. If you want to ensure that you are always wealthy or if you want to pass on your wealth so someone else, then you should do so by owning gold.

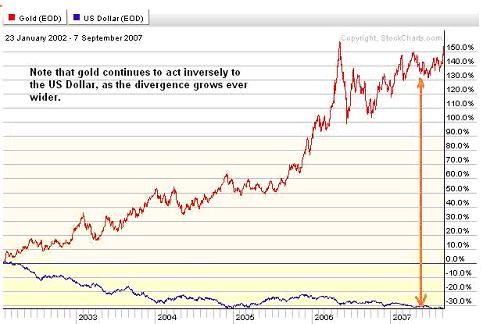

2. Devalue of U.S. Dollar

Whenever the U.S. dollar’s value falls and becomes less than other currencies, people begin to doubt the security of paper currency. Instead they begin to start purchasing gold, causing gold raise in value. For example, during the fall of the U.S. dollar between 1998 and 2008, the value of gold nearly tripled.

3. Inflation

If you want to avoid the problems that come with inflation, then you should invest in gold. Whenever inflation occurs, gold tends to increase in value.

4. Deflation

During a time of deflation like in a recession or depression, chances are, the government will be going into overdrive “fixing” the problem. Gold might drop in the short run, but it’ll pop when the government policies go into play.

5. Increased Demand

As the world’s population increases and as investors begin to purchase more gold, the demand for gold increases, which also causes the price of gold to increase.

6. Diverse Profile

If you’re an investor, you definitely want a diverse profile that includes gold. When things are going bad for other assets, you will still have gold to depend on.

7. Less Supply

Despite the increased demand, there is still a small supply of gold. Due to the less supply, the price of gold is high.

8. US Stock and Bond Markets

Stocks and bonds provide an income and are wonderful — until they go belly up. Gold doesn’t go belly up. That’s long-term security.

9. National Debt

The national debt is just going to get worse as a percentage of GDP. Especially with Obama in the White House. He seems hell-bent on destroying the US economy over the long haul. His policies have nothing to do with “fixing” the economy — he just spends inefficiently and pushes us further into unsustainable debt. Someday we’ll need to pay that debt — and taxes won’t be able to cover it all. We’ll have to print our way out.

10. More Options

Unlike when it comes to investing in paper money, you have lots of options when it comes to investing in gold. You can invest in gold coins, gold stocks, or gold bullion.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

0 comments:

Post a Comment